Do You Need Pay Stubs For An Auto Loan

Getting a new car is great, but you need to put a lot of money into it. Not too many people can afford to get a new auto by paying in cash, and most of us need to take a loan for this purchase. There are so many details that come into getting a loan, and you need to prepare all the documentation beforehand.

When you go to apply for a bank loan, you will need to provide your identification, insurance, down payment, information about the vehicle you want to purchase, as well as proof of income. There are many ways to provide proof of income, and here we are going to talk about the pay stubs. Continue reading you want to learn more about the real paystub, how it can help you get the car of your dreams, and do you really need it when applying for a loan.

Why do you need proof of income?

Source: jetsettimes.com

The first thing we are going to talk about is the process of getting your cash from a lender. We all want to get the money we need to make the purchase we want, but we need to show that we can pay that money back in the given time. Almost all the lenders are going to show you proof that you are making a monthly income, and if you cannot provide this document, then, chances are, you are going to get declined.

Note that this standard practice is used with most of the lending services, and this is a rule in every county in the world. So, even though the rate and the taxes may be different, one thing is for sure – you will need to show that you have a stable job if you want a service to give you the cash you need. Some lenders will need you to have a good credit score for them to give you the money, while others don’t care about that. In any case, the better your score is, the lower the interest you are going to pay.

So, this means that you will need to provide a real paystub or any other type of income document that will show the lender you are eligible for this process. The minimum monthly income depends mostly on the service, as well as the amount you need. So, the rule of thumb is, the more money you need, the bigger your income should be. Usually, if you want to apply for a standard loan, and if you use a real paystub to show how much you are earning, your income should be between one and two thousand dollars. Again, this also depends on your location, so, you should talk to the lenders and see what their requirements are to approve your application.

How can the real paystub help?

Source: kiaofsouthaustin.com

Now let’s talk about the check stubs, and how they can help you out with the process. Before we delve into the process, we will give you more information on the real paystub. The pay stub creator can help you make the needed proof of income, and it can be generated on a lot of different platforms available online. This document is usually accepted by all lenders, and they see it as legal proof.

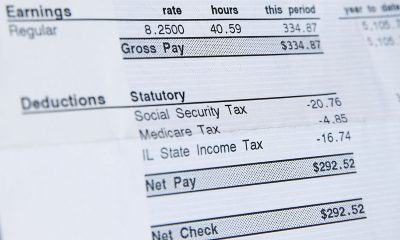

When you check a pay stub example, you will see that this document contains every piece of info that you may need, and in it, your earnings, along with overtime and taxes will be featured. Note that you can add more or less information depending on your needs. You will provide proof of your net pay, the net check, along with benefits and other valuable data. The best thing about this document is that the real paystub shows the date when it was generated and you can get one depending on the bank requirements. You can read more here about the details the real paystub contains, along with the benefits you are going to get from it.

The only issue with these documents is that there are some fake check stubs, so the lenders need to always check to see if they are dealing with the real thing, or if the applicant is trying to trick them. Before acquiring this document, you should talk to the service, and see if they will accept it. On the same note, ask them if you need to provide any other type of proof about the legality of the real paystub.

The easiest way to check if the document provided is fake or legal is to check the bank statement. This is what lenders usually do, and they always make sure they are dealing with genuine documents. Note that the applicant needs to sign a form that shows the copy of tax returns, so in case they try and trick the lender, they will get caught by the IRS. Even though a real paystub is easy to fake, you should never do that and you should know that there are some serious repercussions you are going to face in case you do this.

Talk to your employer about giving you a copy of this document, and make sure everything is properly added. This document is a perfect proof of income, and you can use it for many different things including getting an auto loan. To answer the main question, you don’t have to provide a real paystub if you want to get a car loan, however, it is the easiest way to show how much money you are earning and to show the lender that you are eligible for this loan. There are other methods you can choose, and it ultimately depends on your personal preferences, the service requirements, as well as the lender you choose.

These are some of the things you need to know about this process, and if you want to get things done with ease, you should always talk to the lender before you choose to send your application. If needed, consult with a financial advisor, and ask them what would be the best step forward. Never take out a loan that you cannot pay off, and note that the monthly rate should never be larger than one-third of your paycheck.