3 Common Mistakes to Avoid When Investing in L Bonds

L Bonds are a privately issued financial instrument used for buying life insurance policies. These are a form of alternative investment and were high yielding in the secondary market. These bonds are specifically created by GWG Holdings.

These debt instruments came with a high level of risk but are extensively chosen by investors because of high yields. Because of their popularity, it is easy to make common mistakes in haste that could have been prevented otherwise. In this article, we will mention some of the common mistakes one can avoid while investing in L bonds.

1. Big Wager on Big Yields

Source: seekingalpha.com

The defining feature of L Bonds is that they provide a high yield. However, the biggest mistake comes when people decide to invest a high amount on them. A diverse investment portfolio is the best way to make the most of your investment and not lose your money on just one investment. This is because high yielding bonds typically have a major disadvantage that one needs to consider.

Typically investors go for a bond when its value falls and hope for higher yields in the future. If a bond has low credit qualities it is not worth investing in. This comes with significant risk that one needs to be aware of at the time of investment.

2. Going Too Much by the Yield Curve

Source: britannica.com

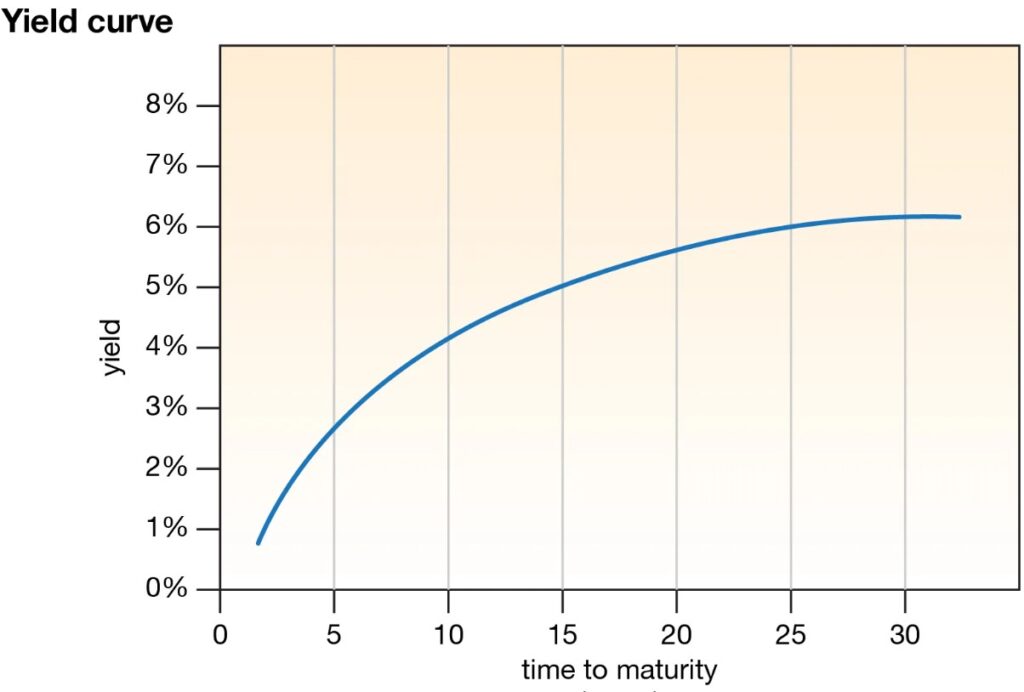

It is good to be aware of where the bonds can possibly go in the long run but relying too much on the yield curve can misguide you. In case the yield curve is flat for both short term and long term bond rates investors often switch to short term majority from long maturities.

If one goes for a shorter maturity it does not help much when it comes to the stability of your investment portfolio. The GWG L Bonds are supposed to stay in your portfolio even if the yield curve is flat. Staying long term will also increase your chances of gaining when something favourable happens.

3. Not Caring About Inflation

Source: usatoday.com

Inflation can directly affect the payments you will get from the bond interest so not paying attention to it can cause you problems. Make sure you are in the loop with how inflation impacts investors. All the investors buying bonds below the rate of inflation are likely to lose money over time. All of the investments in the portfolio should be chosen only after looking at the inflation at a particular period of time.

The Takeaway

L bonds are not fixed to only specific segments in the market. They provide high yields which makes it easy for investors to be misled into making preventable mistakes. Looking at the inflation and understanding what the yield curve represents will help investors make visor decisions. It is also important to not be misled by bigger yields and make impractical investment choices. There is always a chance of losing your money so having four side on market trends is essential.